Report: The Big Money in Tax Breaks Continues

April 18, 2014 - Download PDF Version

National Priorities Project updates trillions in tax breaks, who benefits, and why it matters for you.

By Becky Sweger

Data support by Mattea Kramer, Jasmine Tucker, and Asher Dvir-Djerassi

The federal tax code includes hundreds of tax breaks (called tax expenditures within the federal government) meant to encourage activities that lawmakers deem beneficial to society. From the perspective of the government, tax breaks are no different from any other kind of government spending. In both cases, the U.S. Treasury has less money, and a government activity – whether subsidies for home buying, repairs to an interstate highway, or tuition support to college students – receives funding.

Big Spending, Little Oversight – with Trillions at Stake

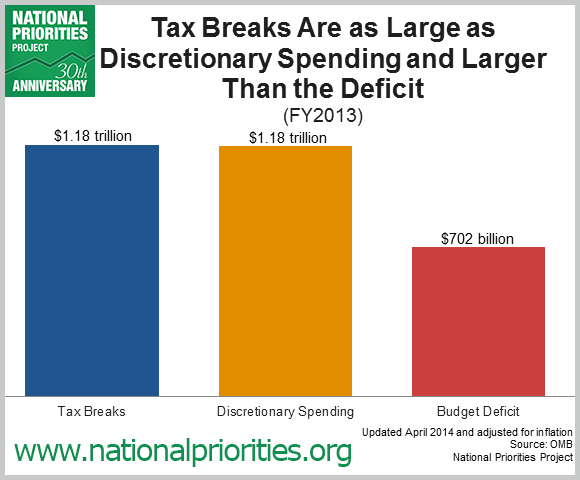

In 2013, the cost of tax breaks was equal to the entire U.S. discretionary budget [1]. However, the discretionary budget is subject to an annual appropriations process, where Congress debates the proposed spending. Tax breaks, on the other hand, remain on the books until lawmakers modify them. As a result, over a trillion dollars a year in lost revenue – more than 1.6 times the 2013 budget deficit – goes largely unnoticed.

Tax breaks deserve just as much oversight and public attention as the rest of the federal budget. Every dollar the government spends on a tax break is a dollar it can’t spend elsewhere – whether on early-childhood education, environmental protection, or infrastructure improvements. Yet few Americans are aware of how much spending occurs through the tax code or who benefits.

Corporate Tax Breaks

The cost of corporate tax breaks has trended upward in recent decades, totaling nearly $176 billion in fiscal 2013. In other words, the overall U.S. corporate tax bill was $176 billion lower than it would have been without the special deductions, credits, and exclusions written into our tax code. To put that in perspective, that’s about $1,328 per U.S. household. [2]

The largest corporate tax break allows multinational corporations to defer paying taxes on offshore profits, costing the government $65 billion in 2013 alone. That comes out to $494 per household. [2]

Big Tax Breaks Offer Deep Savings for the Wealthy

Tax breaks for individual taxpayers exceeded $1 trillion in fiscal 2013, but all individuals do not benefit equally. Major tax breaks that totaled more than $770 billion in tax savings in 2013 are tilted heavily in favor of the top income earners. According to the Congressional Budget Office, 17 percent of the benefits from major tax breaks go to the top 1 percent of households. [3]

In fact, the Tax Policy Center estimated that 4,000 taxpayers in the top 1 percent owed no income tax at all in 2013, thanks in large part to tax breaks that helped them reduce their tax liability down to zero. [4]

| Select Top Tax Breaks for Individuals | Cost to U.S. Treasury in 2013 | Share of Benefits Going to Top 5% ($209,500 income and above [5] | Share of Benefits Going to Top 1% ($462,500 income and above) [4] |

|---|---|---|---|

| Exclusion of Employer-Sponsored Health Care Employer payments for employee health insurance are tax-exempt. |

$191 billion | 10% | 2% |

| Special Rate on Capital Gains and Dividends Money earned from selling stocks and other assets is taxed at a special low rate. |

$97 billion | 82% | 68% |

| Exclusion of Employer-Sponsored Retirement Plans Contributions to certain retirement plans are tax-exempt. |

$91 billion | 36% | 14% |

| Deduction of Home Mortgage Interest Interest on a home mortgage is tax-deductible. |

$71 billion | 38% | 15% |

| Deduction of Charitable Contributions Contributions to charitable organizations are tax-deductible. |

$50 billion | 59% | 38% |

| Source: OMB, CBO | |||

Washington Contemplates Reform – And You Can Have a Say

In February 2014, Representative David Camp (R-MI), chairman of the House Ways and Means Committee, released the “Tax Reform Act of 2014,” a 980-page plan to overhaul the tax code. His counterpart, Senator Ron Wyden (D-OR), chairman of the Senate Finance Committee, has called for reform of the “dysfunctional, rotting mess of a carcass that we call the tax code.” [6]

However, in this election year, it’s unlikely that Congress will pass comprehensive tax reform. Instead we may see less sweeping changes, perhaps enacted as part of the budget. Sixty-seven percent of Americans want a budget that closes corporate tax loopholes and limits tax breaks for the wealthy. [7] Here’s how the current budget proposals stack up: [8]

| President Obama | Rep. Paul Ryan and the House Budget Committee | House Congressional Progressive Caucus |

|---|---|---|

|

Places limits on tax deductions for top income earners and implements Buffett Rule to collectively raise $651 billion over 10 years. Ends the “carried interest” loophole that benefits hedge fund managers and eliminates special tax breaks for corporations (raises $13.8 billion over 10 years). |

Plans to close tax loopholes to simplify the tax code but does not specify which ones. |

Places limits on tax deductions for top earners. Limits corporate loopholes for stock options, executive bonus pay, jets, and meals and entertainment to raise $153 billion over 10 years. Also eliminates the home mortgage-interest deduction for vacation homes and yachts to raise $14 billion over 10 years. |

| Source: budget proposals released by the White House, House Budget Committee, and Congressional Progressive Caucus | ||

You have the opportunity to influence this process by communicating with your legislators about what you believe should be done. Are certain tax breaks important to you? Do you believe some tax breaks should be eliminated from the tax code? This is your opportunity to influence Washington. Take Action.

More Resources

- Interactive Visualization: See the cost of tax breaks, how they’ve changed over time, and who benefits.

- Complete Data on Tax Breaks: Download data and explore the cost of every tax break every year from 1974 to the present.

- Federal Budget 101: Understand who decides the federal budget, where the money comes from, and where it goes.

Numbers updated April 2014 to reflect the latest Treasury Department tax break estimates.

Endnotes

- Unless otherwise noted, all numbers are drawn from the White House Office of Management and Budget, Analytical Perspectives, Chapter 14: Tax Expenditures, Fiscal Year 2015 and are adjusted to FY 2015 dollars. Tax break estimates reflect foregone revenue but do not necessarily represent the amount of additional revenue the government would raise by repealing any given tax expenditure.

- 2012 Households, U.S. Bureau, Population Division, http://factfinder2.census.gov/bkmk/table/1.0/en/PEP/2012/PEPANNHU

- Congressional Budget Office, The Distribution of Major Tax Expenditures in the Individual Income Tax System, http://www.cbo.gov/publication/43768. Note that CBO’s report on distributional effects draws on tax expenditure estimates from the Joint Committee on Taxation, while the estimates reported here are those produced by OMB.

- Tax Policy Center, Distribution of Tax Units That Pay No Individual Income Tax, http://www.taxpolicycenter.org/numbers/displayatab.cfm?DocID=3992

- Income thresholds are for two-person households. Source: CBO

- The Hill, True Tax Reform, http://thehill.com/blogs/congress-blog/economy-budget/200477-true-tax-reform

- Americans for Tax Fairness, October 2013 Poll: Winning the Budget Debate, http://www.americansfortaxfairness.org/polls/2013/11/08/atf-oct-2013-polling-materials/

- National Priorities Project, Competing Visions: President Obama, Rep. Paul Ryan, and House Progressives Release Budget Proposals for 2015, http://nationalpriorities.org/analysis/2014/budget-proposals-2015/