Tax Day 2020

March 18, 2020

Tax Day is normally in April, but has been extended this year to July 15, 2020, due to the pandemic. Americans will file their tax returns for all income received in 2019.

In this time of economic and public health crisis, the United States federal government's budget priorities starkly reveal our society's overemphasis on military preparations over funding human needs and resilience against long-term systemic threats.

Want to know what your taxes pay for, and who pays what?

- Get your personalized tax receipt for the past year

- See an average tax receipt for your state

- Don't like your tax receipt? Make your own federal spending choices.

Here are some tax facts for 2020:

Pentagon & Military — the average U.S. taxpayer pays more to private military contractors than funds that directly support the troops.

-

Of every dollar you pay in income taxes, 24¢ goes to the military – but only 4.8¢ goes to our troops in the form of pay, housing allowances and other benefits (excluding healthcare).

-

Out of the 24¢ on the dollar that taxpayers contribute to military spending, 12¢ goes to military contractors.

-

Taxpayers pay about half as much to support our veterans by providing health care, income support and job training, among other benefits (6¢) as we pay private military contractors.

-

The average U.S. taxpayer worked 63 days last year to fund military spending. Only 13 directly supported the troops, while 31 directly supported private contractors.

-

The average taxpayer contributed $185 to Lockheed Martin, the Pentagon’s biggest contractor and maker of the ill-conceived F-35 jet fighter.

-

Meanwhile taxpayers contributed just $110 to child nutrition programs like free school breakfast and lunch. While schools are closed during the coronavirus pandemic, many children still depend on these meals to have enough to eat.

-

-

-

The average taxpayer paid $3,723 for the Pentagon and military, nineteen times more than for all diplomacy and foreign aid ($193).

-

That’s over 100 times as much as what is spent on the Centers for Disease Control and Prevention (CDC), which funds the protection of public health and safety through the control and prevention of diseases — like the coronavirus pandemic — and accounts for just 0.2¢ of every tax dollar, or $36.47 from the average taxpayer.

-

Nuclear weapons — the U.S. spends more on proliferating weapons of mass destruction than we do on foreign aid and diplomacy, the EPA, or disease control.

-

How’s this for promoting peace and actual security? Out of every dollar you pay in taxes, 0.7¢ goes to researching, producing, and proliferating nuclear weapons — that’s $108 for the average taxpayer.

-

That’s twice as much that the United States spends on weapons of mass destruction as it does on foreign aid (0.3¢ on the dollar). The average taxpayer contributes twice as much to nuclear weapons ($108) than to foreign aid ($54).

-

That’s almost as much as we spend on the State Department, our government’s main instrument of foreign diplomacy (0.8¢ on the dollar, $129 from the average taxpayer).

-

-

Nuclear weapons funding is:

-

three times all funding for the Centers for Disease Control and Prevention (0.2¢ on the dollar, $36 from the average taxpayer)

-

more than we spend on the Children’s Health Insurance Program (0.5¢ on the dollar, $84 from the average taxpayer)

-

about as much as we spend on K-12 education (0.7¢ on the dollar, $108 from the average taxpayer).

-

Climate, Energy, & Environment — many more of your tax dollars go to disaster relief than to investments in renewable energy that could help prevent the worst disasters.

-

When it comes to the intensifying global climate crisis fueled by fossil fuel use, we are funding crisis response at the expense of crisis prevention.

-

The average taxpayer paid $81 to deal with the aftermath of natural disasters fueled by climate change (wildfire management ($19) + disaster relief ($62)) — that’s 9 times as much they spent to support the shift to renewable energy ($9) that could lessen climate chaos in the first place.

-

-

The average taxpayer contributed just $39 for the Environmental Protection Agency, which has been threatened with a 26% budget cut (to $6.7 billion) under President Trump’s proposed 2021 budget.

-

That’s just 0.3¢ out of every taxpayer dollar last year for the EPA, in a time of rapidly accelerating climate change.

-

Keeping the EPA fully funded against Trump budget cuts would cost just $10.14 per taxpayer, to help ensure clean air and drinking water, clean up toxic Superfund sites, and keep lead and other dangerous substances out of our environment.

-

-

The military, a major source of global greenhouse gas emissions, gets $3,723 from the average taxpayer, over 400 times as much as they spend on the shift to renewable energy ($9).

-

The average taxpayer pays 12 times as much to fund nuclear weapons ($108) as they do on renewable energy research ($9).

-

Education — the U.S. government spend as much taxpayer money separating families as it does on K-12 education.

-

The average taxpayer paid the same amount ($108) for K-12 education as they did for Immigration and Customs Enforcement (ICE) and Customs and Border Patrol, including family separations.

-

The average taxpayer contributed $329 for college financial aid, less than the $520 they paid for Pentagon contracts to the top 5 military contractors Lockheed Martin, Boeing, Raytheon, General Dynamics, and Northrop Grumman.

Health care — this is the taxpayer’s biggest tab, with Medicare and Medicaid providing health care for 1 in 3 people in the U.S.

-

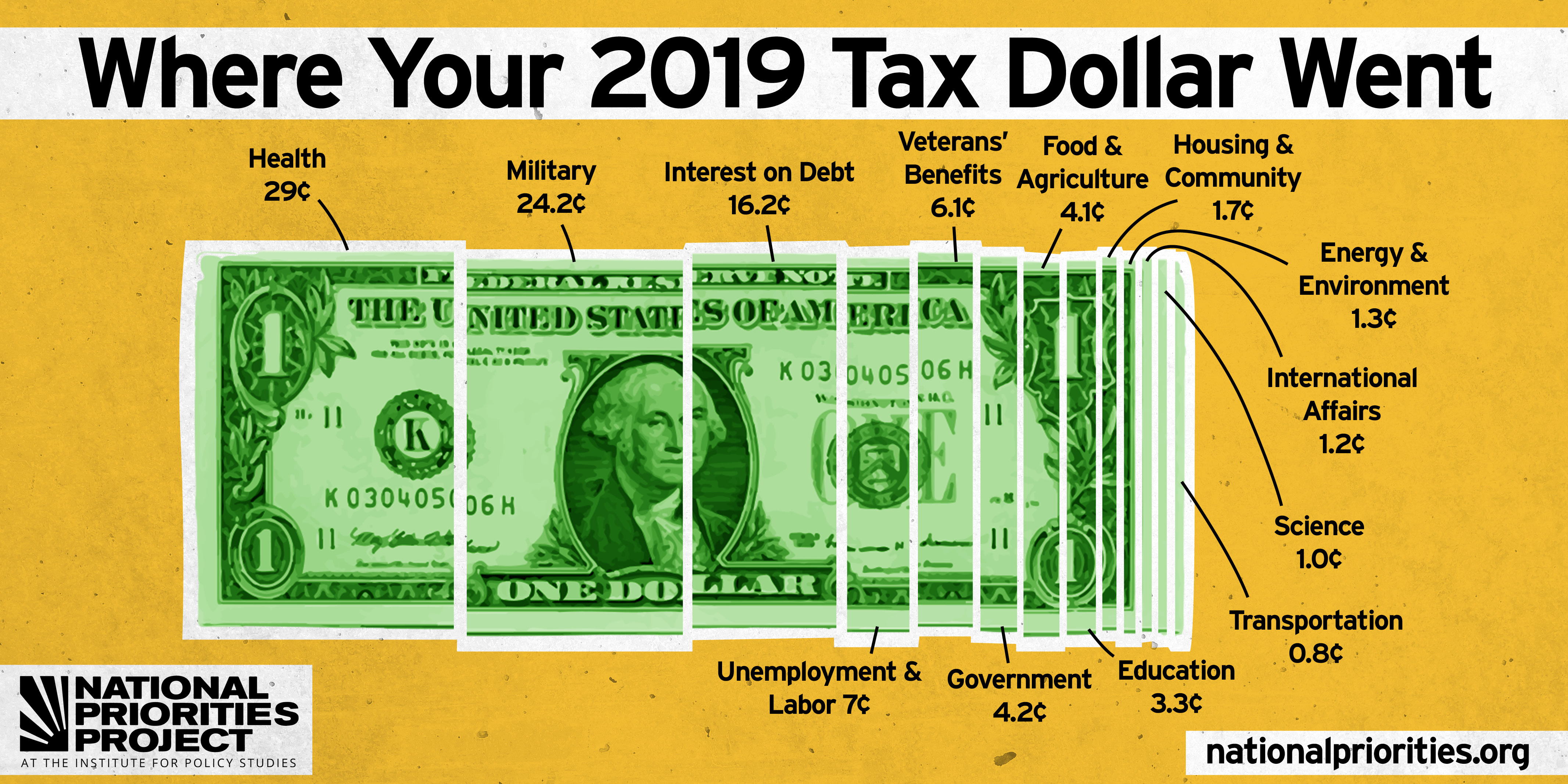

Out of every tax dollar you (and your neighbors) pay, 29¢ goes to health care, including $12.6 cents for Medicaid and $11 cents for Medicare.

-

Together, Medicare and Medicaid provide healthcare for 1 in 3 of all Americans, at rates more cost effective than private insurance.

-

The Centers for Disease Control and Prevention (CDC), which funds the protection of public health and safety through the control and prevention of diseases — like the coronavirus pandemic — accounts for just 0.2¢ of every tax dollar, or $36.47 from the average taxpayer, compared to more than 100 times as much on the military.

-

The Children’s Health Insurance Program, which provides insurance for more than 9 million low-income and poor children, costs just 0.5¢ out of every tax dollar.

Government

-

The average taxpayer paid $12 for the Census Bureau, which counts people living in the United States every decade, producing data that is used to determine congressional representation and the allocation of resources to all communities.

-

Compare that to the $108 spent on immigration and border enforcement agencies, which enact militarized policies that tear families and communities apart.

Poverty and Low-Income — in the age of growing income inequality, the average taxpayer contributes more to private DoD contractors than to labor and unemployment programs.

-

The average taxpayer pays $10 to house the homeless, but over three times as much ($34) to support federal prisons.

-

The average taxpayer pays $42 to fund public housing and assist the homeless, compared to $108 for nuclear weapons.

-

The average taxpayer contributes just $31 for public housing, $18 for heating assistance for low-income and poor people, and $74 to Temporary Assistance for Needy Families (welfare).

-

Altogether, the average taxpayer contributed less to those programs ($123) than to $130 for Department of Defense contracts for Boeing, whose former executive Patrick Shanahan served as acting Secretary of Defense in the Trump administration.

-

-

The average taxpayer contributed $301 to SNAP (food stamps). About one in eight Americans, or 40 million people in all 50 states and across all races, depended on SNAP benefits in 2018, and many more families are depending these benefits during the coronavirus pandemic.

-

In an age of growing income inequality, the average taxpayer contributed $1,077 to labor and unemployment programs like the Earned Income Tax Credit ($281), which returns money to low-income working people, Temporary Assistance to Needy Families ($74), and heating assistance for low-income families ($18), but paid $1,810 to private contractors for the Pentagon.

For more info, check out the landing page for our resources from last year's Tax Day 2019 analysis.