Primary Stakes: Tale of Two Super Tuesday States

By

Mattea Kramer

Posted:

|

Budget Process,

Social Insurance, Earned Benefits, & Safety Net

The presidential election is about voters’ vision for how the federal government should serve the American people. National Priorities Project’s Primary Stakes series examines how residents of primary states currently rely on assistance from the federal government, and two Super Tuesday states illustrate that support from the federal government—and taxes paid—can vary widely.

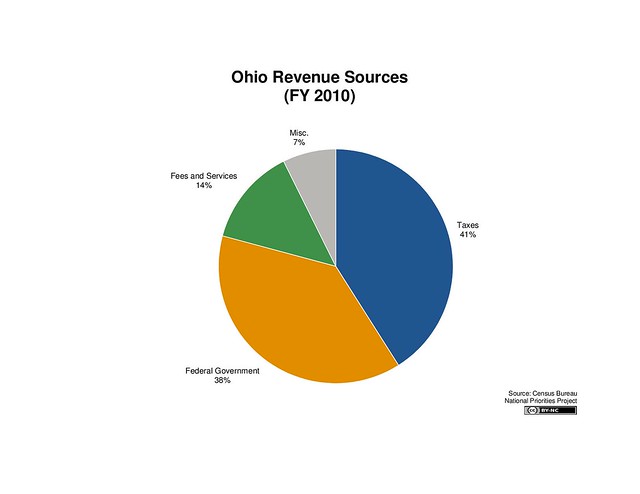

In fiscal 2010, the Ohio state government drew 38 percent of its revenues from the federal government. That money helped the state build roads and fix bridges, among other kinds of projects, and it helped pay the cost of health care for low-income residents.

Ohio was hard-hit during the Great Recession and the state’s median income, $46,093, is well below the nationwide median of $49,445. The average Ohio resident received $5,575 in direct federal assistance in 2010. That’s support from programs like Social Security, Medicare, and unemployment insurance. Residents of the state paid substantial federal taxes, however, with the average Ohioan sending $8,360 to the federal government in 2010. That includes income and payroll taxes as well as federal excise taxes on items like cigarettes.

Federal support in Virginia tells a different story. The median income is $60,363 in Virginia, the seventh highest in the nation. Still, the average Virginia resident received nearly as much direct assistance from the federal government as Ohioans did—$5,171 in 2010. And despite being far wealthier on average than residents of Ohio, Virginians paid substantially less in federal taxes. The average Virginian paid $6,251 in federal taxes in 2010.

Virginia’s state government drew only 25 percent of its revenues in 2010 from federal sources.