You Ask, We Answer: Do Some People Pay No Taxes at All?

By

Chris Hellman

Posted:

|

Budget Process

NPP’s new report “The Untold Story of Deficits in Washington” has sparked a LOT of questions about federal revenues – the “budwonk” word for “taxes” – especially this one: “Is it true that half of all Americans pay no federal taxes?”

Here’s the deal. Because many people don’t earn enough to owe federal income taxes, and because of deductions and credits like the Earned Income Tax Credit, many Americans end up paying no income taxes, or even pay negative income taxes – that is, they actually receive a check from the U.S. Treasury.

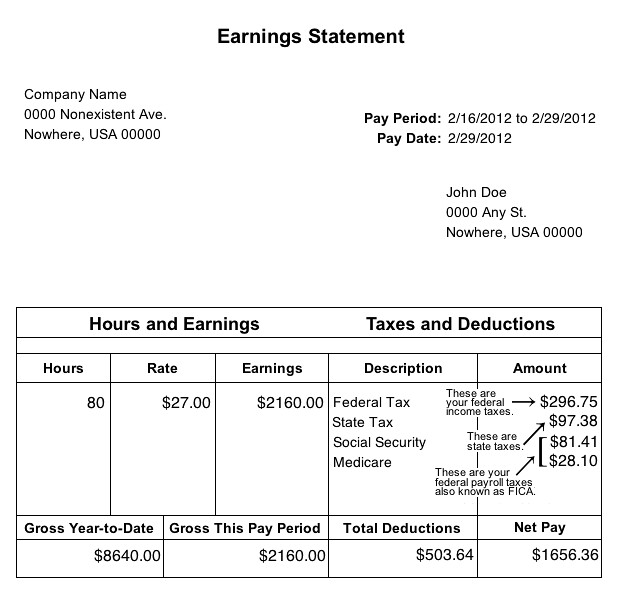

But that doesn’t mean they pay no taxes. First, virtually all wage earners, regardless of income level, contribute to Social Security and Medicare through their FICA payroll tax which is taken directly out of their paychecks. In fact, according to the Congressional Budget Office (CBO), more than half of all taxpayers pay more in payroll taxes than they do in income taxes.

Second, all people pay federal excise taxes when they buy gasoline, cigarettes, and a host of other items, or on certain activities, like wagering. And like the Social Security tax, these excise taxes are actually regressive, because working-class people spend a far greater share of their incomes on consumer goods than do their wealthier counterparts.

So as Ben Franklin famously said, “In this world nothing can be said to be certain except death and taxes.”