Worried About Spending? Don't Forget the Revenue.

By

Becky Sweger

Posted:

|

Budget Process,

Transparency & Data

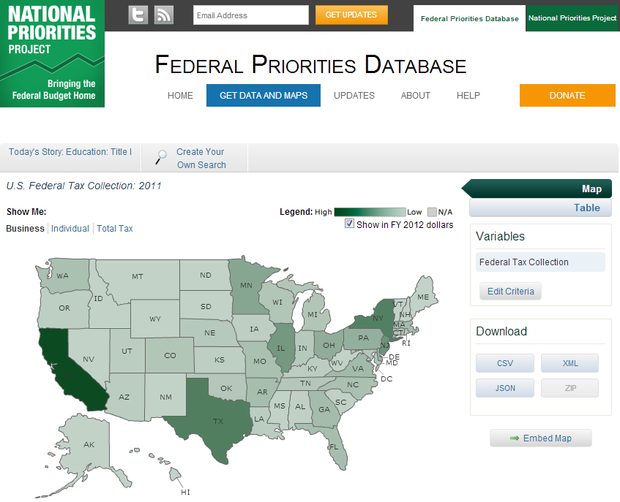

One of the many sources of open government data that NPP scrubs and publishes in the Federal Priorities Database is U.S. Federal Tax Collections. We're highlighting federal income taxes this week as tax season gets into full swing.

With sequestration and Fiscal Cliff II looming, Congress and President Obama are once again tackling the spending side of the federal budget. But spending is only half of any budget. The income taxes due on April 15 — along with the excise, payroll, estate, trust, and gift taxes that we pay — are the other half of our nation's budget: revenue.

U.S. Federal Tax Collections breaks down federal tax collections by state, and we have the data back to 1998. Want to see how much business or individual income tax the IRS collected from your state in 2011? 1999? It’s all on the map and available for download.

We hope that this and other data in the Federal Priorities Database can help show the effects of federal spending and taxes in your state and county. Get informed, and join our Demand a Better Budget campaign.