Where Your Tax Dollars Go: Federal Funds vs. Trust Funds

By

Lindsay Koshgarian

Posted:

|

Budget Process,

Taxes & Revenue

Of every dollar you pay in federal income taxes, about 27 cents goes to the military, a little less than 27 cents goes to health care, fifteen cents for payment on the national debt, and a little more than 30 cents goes to everything else.

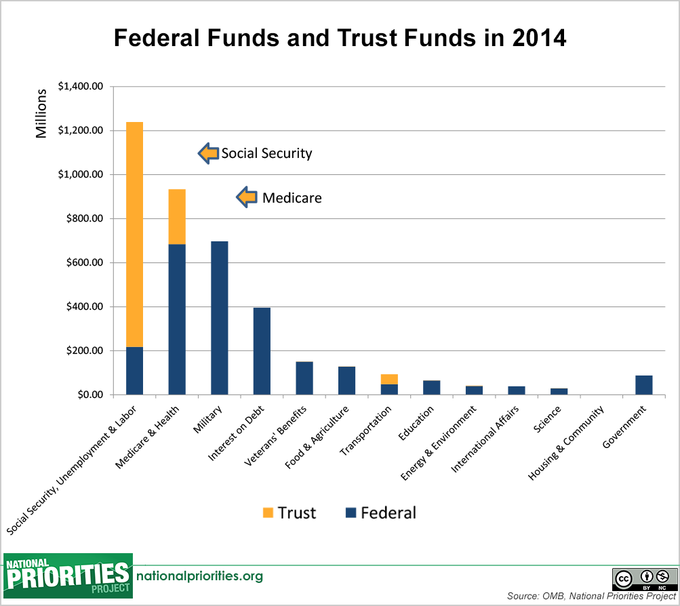

Another way to look at it is that your federal income taxes go into what’s called “federal funds,” which is the name for the pot of money the federal government collects for general purposes. In addition to federal funds, there are “trust funds,” which the federal government collects for specific purposes.

Unlike your federal income taxes, payroll taxes – what likely appears on your paystub as FICA, Social Security, or Medicare – don’t go into the big pot of federal funds, but instead go into trust funds. The tax you pay for Social Security is counted in the Social Security trust fund, not in federal funds, and likewise for Medicare. That means payroll taxes are not available for federal spending on the military, education or other programs. Another example of a federal trust fund is the Highway Trust Fund. The Highway Trust Fund is paid for by federal gas taxes, and is used for road and infrastructure repairs and improvements all around the country.

But most spending categories – from the military to education – don’t have trust funds of any significant size, which means they have to rely on federal funds that come largely from income taxes. On Tax Day, it’s all about federal funds that pay for the military, certain health care programs like Medicaid and the Children’s Health Insurance Program, education and other things.

Our Tax Day materials, like our income tax dollar and tax receipt show you what becomes of your income tax dollar after it joins the big pot of federal funds. Trust fund expenses like Social Security and Medicare aren’t included – they’ll have to get their own day.