Tax Day 2017: Taxes and All the Feels

By

Nora Ranney

Posted:

|

Military & Security,

Taxes & Revenue

If you are like me, Tax Day always comes with some emotion – be it anxiety (did I do it right?), panic (I’m not done!), or going postal (where are my damn stamps and why am I in this line?).

Then there's how I feel about where my tax dollars actually go. NPP’s Tax Dollar is the kind of practical research that brought me here in the first place, and that our partner organizations rely on to share with their members, representing a myriad of issues and movements. (Just saying.)

So aside from tax returns, how do I feel about taxes?

They make me feel a part of something bigger than myself. Taxes are like membership dues. We pay them to fund our priorities – the services and programs we care about – and they are also an investment in our country’s future. They go back into our communities and pay for things we value, like Medicare and Social Security.

But it is more than that. Our federal budget is a reflection of our country’s values, of how we express and implement our moral code.

And our moral statement makes me furious!

Because our political system has allowed the tax system to be manipulated by moneyed special interests, we have a tax system that fails to accurately reflect my priorities. And what does this mean?

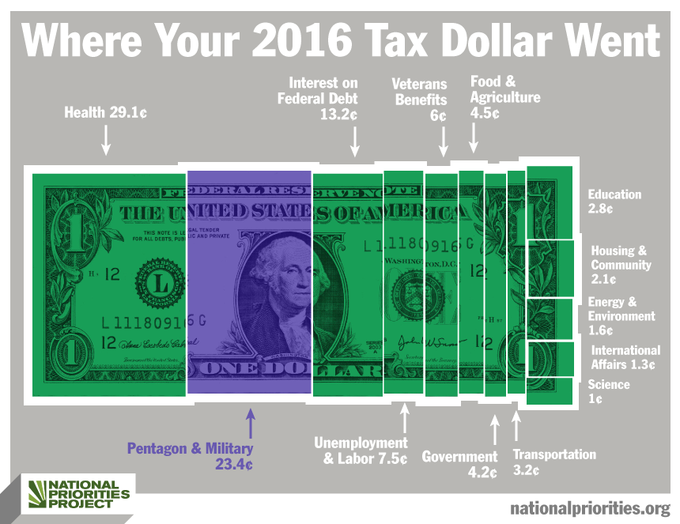

Where Your Tax Dollars Go:

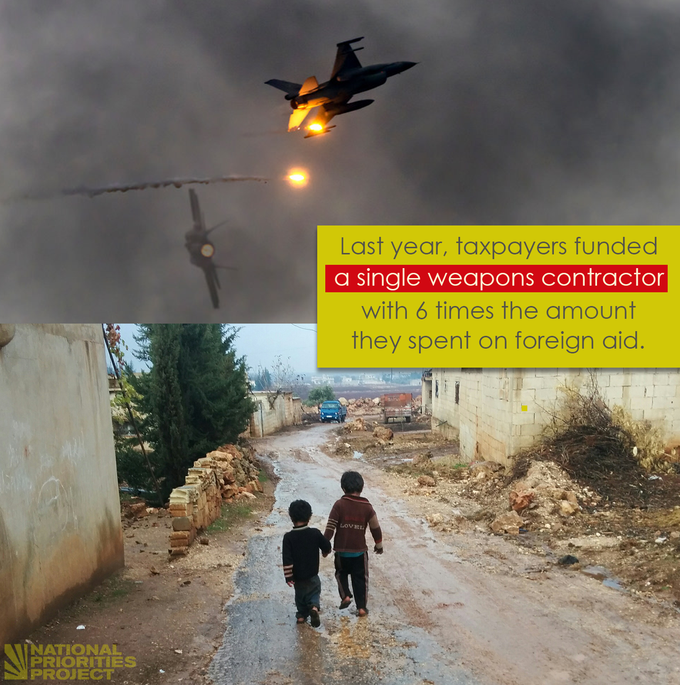

We are making defense contractors wealthy. Just one company, Lockheed Martin, had so many federal contracts that we each contribute six times more to Lockheed than to all foreign aid. No wonder our international responses tend toward the military first.

We are overspending on the wrong things. U.S. military expenditures are roughly the size of the next seven largest military budgets around the world, combined.

Many of the most profitable companies in the U.S. don’t even pay taxes.

Taxes frustrate my sense of fairness. When you think you are paying more than your fair share, consider that we pay taxes in many different ways. When you send in your tax return on or before Tax Day, your check – or your return – only reflects part of the story. We pay property taxes – even as renters, this gets folded into our monthly rent check. And that last trip to buy gas, pay the phone bill, or buy a consumer good? This is also taxed.

Yes, we have a progressive federal income tax system in name, but many end up paying less than their income alone would suggest. For example, there are deductions, exemptions and credits that lower our taxes. And that doesn’t even include the fact that different forms of income are taxed at different rates – investment income, for example, is taxed at a lower rate – benefiting those with stock portfolios most.

So I can say the thing that makes me the most happy about taxes right now is that mine are done – but for me, taxes are far from a done subject. Whether you agree with me about budget priorities or not, we can agree that we pay taxes. And they should matter.