Federal Budget Tipsheet: Social Insurance and Earned Benefits

Social Insurance and Earned Benefits: Key Fact

Social insurance is made up of programs that help workers and their families replace income lost due to unemployment, disability, retirement, or death, as well as ensure access to adequate health care. Every year, millions of Americans rely on programs like Social Security, unemployment insurance and Medicare. These programs will touch nearly all Americans during their lifetimes, as most people draw Social Security when they retire or rely on government-funded medical care in old age. In 2015, the U.S. will spend $900.5 billion on Social Security and $38.8 billion on unemployment insurance.[1]

Federal Spending on Social Insurance

Social insurance and earned benefits are funded through mandatory spending. Unlike discretionary spending that is determined with the annual approval of Congress, mandatory spending is controlled through eligibility requirements and benefit levels specified in existing authorizing legislation. This makes benefits much more reliable (and expenditures more predictable) than if they were subject to annual appropriations decisions by Congress.

Key Programs

Social Security: $1,218 per month[2]

Unemployment Insurance: $318 per week[3]

Social Security is a social insurance program that workers and their employers pay into. The program serves more than 59 million people every year by providing retirement and disability benefits to workers and their families, as well as survivor benefits to the spouses and dependents of deceased workers.[4] Unemployment Insurance is a federal-state social insurance program that provides temporary income to those who have lost their jobs through no fault of their own and who are ready, willing, and able to work. Another key social insurance program is Medicare. See bit.ly/NPPhealthcare for more on federal health care programs.

Social Security Is Not Going Broke

Social Security is funded with a payroll tax that comes directly out of your paycheck, and it does not face an urgent funding crisis. Workers paying into the Social Security program directly finance Social Security benefits for current beneficiaries.

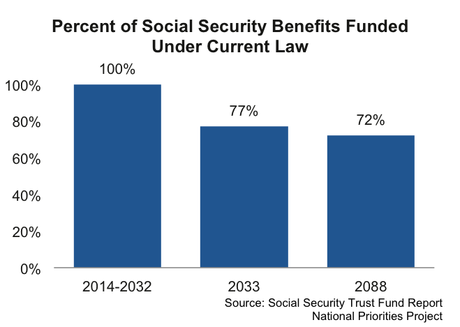

In 2014, Social Security had a substantial trust fund of $2.8 trillion. Between the trust fund, which has been built over decades, and incoming payroll taxes, Social Security is expected to be able to pay 100 percent of benefits until 2032 with no changes to the program. By 2033, if lawmakers haven’t made changes, Social Security could pay out 77 percent of benefits, and by 2088 Social Security could pay 72 percent of benefits. [5] It would take relatively small changes to the program to ensure that it could continue to pay out 100 percent of benefits – or even more.

In 2014, Social Security had a substantial trust fund of $2.8 trillion. Between the trust fund, which has been built over decades, and incoming payroll taxes, Social Security is expected to be able to pay 100 percent of benefits until 2032 with no changes to the program. By 2033, if lawmakers haven’t made changes, Social Security could pay out 77 percent of benefits, and by 2088 Social Security could pay 72 percent of benefits. [5] It would take relatively small changes to the program to ensure that it could continue to pay out 100 percent of benefits – or even more.

President Obama’s 2016 Budget

The president’s budget proposal supports a transfer of funds from Social Security’s retirement program to its disability insurance program to ensure the continued viability of the disability benefits program until further changes can be made in Congress. This contradicts a rule proposed by House lawmakers in January that would prevent such transfers. Reallocating funds from one trust fund to another, which Congress has done 11 times in the past, has historically been a non-controversial measure that prevents cuts to Social Security benefits. The President’s proposal would also close loopholes that allow some high-income individuals to avoid Medicare and Social Security payroll taxes, which could provide the program with as much as $10 billion more per year by the end of the decade.

Public Opinion

Americans think Social Security and the economy should be top priorities for the federal government in the next year.[6] More than 8 in 10 Americans don’t mind paying Social Security taxes, and many would be willing to raise payroll taxes and make income over the earnings cap taxable in order to ensure the program is on sound financial footing.[7] Currently, Social Security tax applies only to an individual’s first $118,500 in wage income.

- More on Social Insurance and Earned Benefits

- For county-level data on Social Security, see bit.ly/nppdata

Footnotes

- Office of Management and Budget, 2016 President’s Budget. Historical Table 5.1.

- Social Security Administration, Monthly Statistical Snapshot, March 2015. Average benefit is as of March 2015 and accounts all types of benefits, including retirement, survivor’s, and disability.

- Average benefit is as of the fourth quarter of 2014.

- Social Security Administration, Monthly Statistical Snapshot, December 2014.

- Social Security Trustees Report 2014.

- Gallup poll, conducted January 7-11, 2015.

- National Academy of Social Insurance, Americans Make Hard Choices on Social Security: A Survey with Trade-Off Analysis, October 2014.