Defense Contractors Are Using Tax Dollars to Profit Off War in Ukraine

NPP Pressroom

Truthout

Jonathan Alan King

06/07/2022

If United States taxpayers knew that half the income tax dollars they sent to the Internal Revenue Service every year was being spent on weapons, war and war preparation, political support for such programs might significantly decline. Unfortunately, no agency of the federal government communicates to taxpayers how the Congress spends their money.

Massachusetts State Rep. Carol Doherty and State Sen. Jo Comerford have introduced a bill into the state legislature, the Taxpayers’ Right to Know Act, supported by Massachusetts Peace Action and allies. The bill instructs the state treasurer to communicate to Massachusetts taxpayers how the state and the federal government spend their income tax dollars. This is a first step toward federal legislation bringing transparency to the Congressional Discretionary Budget.

Organizers hope to promote such bills in other states, given the roadblock against such open and honest reporting from the federal government. These are small but important first steps in focusing attention on income taxes being used to finance corporate drivers of dangerous and costly nuclear weapons purchases, especially in the context of Russia’s invasion of Ukraine.

Ukraine War Profiteering

Purchasing weapons and military services with taxpayer dollars has always been, and continues to be, a highly profitable endeavor for defense contractors. But it is in a real war, such as in Ukraine, that such profiteering truly thrives.

President Joe Biden recently sent to Congress his budget proposal for 2023. It included an astounding $813 billion for Pentagon and military expenditures. This is more than half the income taxes citizens send to the federal government each year, and a more than $31 billion increase over the already bloated fiscal year 2022 Pentagon budget. It also more than the defense budgets of the eight next biggest military spenders put together, including Russia, China and India.

The proposed increase for 2023 was cloaked in the flag of support for Ukrainians, but make no mistake, most of this bloated budget was in the pipeline years back, prior Russia’s invasion of Ukraine.

[...]

The Pentagon Budget Is Only Peripherally for Protecting Ukrainians

Earlier this year Congress voted $768 billion as the 2022 Defense authorization. Such bloated budgets have been voted for many years and are not a response to events in China, Ukraine or any actual foreign or military threat. Thus the 2021 Congressional Discretionary Budget was voted in 2020, long before the Ukraine conflict.

[...]

At the same time Congress voted some $782 billion for Pentagon accounts, they couldn’t find the $5-$10 billion needed to insure that vaccination against COVID-19 is available to all Americans.

One of the components of the bloated $782 Pentagon budget is for purchase of new nuclear-armed submarines, even though the U.S. already has 14 lethal Ohio Class submarines, each capable of launching 192 nuclear warheads. Cancelling two of these unnecessary and provocative new weapons systems would save more than $10 billion. This would easily provide the funds needed to insure vaccination for all Americans from COVID, and also to finance vaccines for those in under-developed economies.

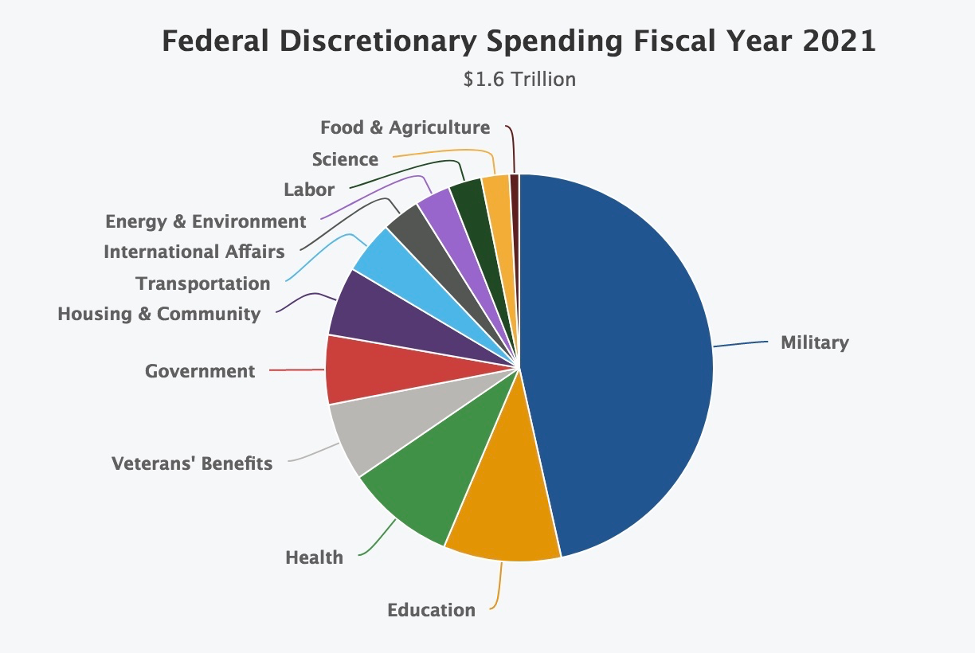

The pie chart below shows the division of the Congressional Discretionary Budget for 2021 — pre-Ukraine — among competing agencies and programs including the Defense Department, Veterans Affairs, the Department of Health and Human Services, food stamps, agricultural subsidies, the Department of Energy (nuclear weapons) and the National Science Foundation. (The discretionary budget does not include the two major mandatory funds Medicare and Social Security. These are trust funds — citizens pay in and hopefully are paid back. Congress cannot use these funds for other purposes.) A number of the categories in the annual congressional budget (from income taxes) are labelled here:

This pie chart from the National Priorities Project shows the allocation of our Congressional Discretionary Budget among diverse categories for the 2021 fiscal year, voted on in 2020, prior to Russia’s invasion of Ukraine. The military sector is underestimated, since a number of military-related programs, such as nuclear weapons and foreign military aid, are listed under domestic programs.

The single most important fact is that more than half of the income taxes remitted to the U.S government are spent on Pentagon accounts. In general, citizens are not aware of the scale of these expenditures. Though the government is aggressive in collecting income taxes, no agency of the government reports back to the taxpayers how their tax dollars are spent. Thus, many Americans assume that taking care of service men and women wounded in war or other military actions are covered by the defense budget. In fact, Veterans Affairs and veterans’ hospitals are part of the civilian or “domestic” budget, often squeezed by pressures of the military-industrial-congressional complex to increase funding for the Pentagon.

Pentagon Spending Versus Preventing Disease

It’s very difficult to grasp the impact of a $782 billion Pentagon budget. One approach is to compare it to other appropriations. For the past two years, our nation and all the nations of the world have faced the crises of the COVID pandemic. The virus has killed more than 1,000,000 Americans. How did this happen in the wealthy, technologically advanced U.S., the world leader in biomedical research and development, biotechnology and pharmaceuticals?