You Ask, We Answer: Is Social Security Part of the Federal Budget?

By

Mattea Kramer

Posted:

|

Budget Process

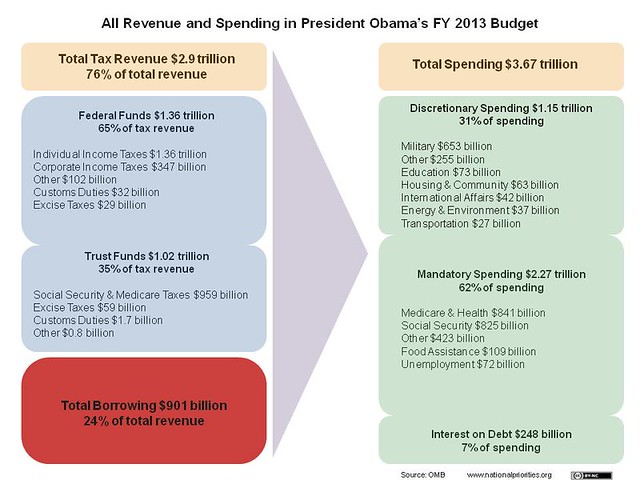

Many of our Facebook fans have been asking why we include Social Security in our charts about federal spending. The gist of the questions has been: If Social Security is funded by a dedicated source – taxes taken directly out of our paychecks – then shouldn’t Social Security be shown separately from other kinds of federal spending?

Most of the cost of Social Security is indeed funded out of payroll taxes, which are called “trust funds” because lawmakers can use that money only to fund Social Security. But that doesn’t mean we should ignore Social Security when we examine the federal budget – it's part of the story of federal taxes we pay and federal benefits we receive.

Furthermore, our Facebook fan Trish was particularly curious about why Social Security was included in a chart showing where our 2011 federal income taxes went. If Social Security is funded by payroll taxes, then why was it included in a chart about income taxes?

As you may know, there is currently a payroll-tax holiday in effect; workers are paying 4.2 percent of wages toward Social Security, instead of the normal rate of 6.2 percent. And because of that rate reduction, trust fund revenues were not sufficient to cover the costs of the Social Security program in fiscal 2011. Thus general fund revenues (which mostly come from your federal income taxes) were used to pay for part of the cost of Social Security in fiscal 2011. Some experts worry that the payroll-tax holiday undermines the Social Security program by compromising its dedicated funding source.

National Priorities Project will continue to include Social Security in our charts and discussion of the federal budget. Here’s a chart that puts together all the pieces of the puzzle so you can see Social Security – as part of revenues as well as spending – in the proposed budget for fiscal 2013: