The Shakedown on the Payroll Tax Cut Extension

By

Mattea Kramer

Posted:

|

Social Insurance, Earned Benefits, & Safety Net

In Monday’s budget brief, NPP’s senior research analyst Chris Hellman explained the payroll tax cut and President Obama's proposal to extend it. But the proposal is controversial—it's been criticized by both Democrats and Republicans. Republicans argue that President Obama must find a way to offset the tax cut by cutting expenditures elsewhere (the President has proposed paying for it by raising taxes on the wealthiest Americans, something that Republicans oppose).

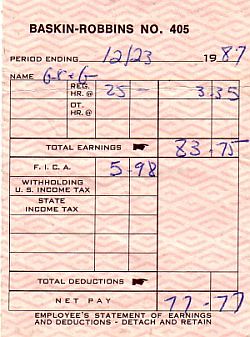

Democrats have also expressed disapproval of the payroll tax cut extension, but for a different reason. The payroll tax is a special kind of tax because it directly funds Social Security. That is, most of the money deducted from paychecks as payroll taxes goes straight into the Social Security program. Check out this paystub from 1987—the hourly wage was $3.35 per hour—and this worker's contribution to "FICA." That stands for the Federal Insurance Contributions Act, which imposes the payroll tax to fund Social Security.

That’s why Social Security is called an earned benefit—workers pay into the program through payroll taxes and then draw a monthly check after retirement. Democrats are worried about extending this tax cut because it takes money out of the Social Security program. White House officials point out that $105 billion was put back into Social Security this year to offset the effects of the tax cut so far (that $105 billion came from other taxes, as well as borrowing). Thus, according to the White House, Democrats in Congress need not worry that this tax cut extension robs Social Security.

But that doesn’t solve the problem, National Public Radio recently reported. Cutting payroll taxes undermines the long-held notion that Social Security is self-financing—and if it is no longer self-financing, it could be considered ripe for cuts in the current deficit-reduction frenzy.