You Ask, We Answer: Money Gone Missing?

By

Mattea Kramer

Posted:

|

Budget Process

Ronda of Kennewick, Washington, wrote in to ask about tax revenues. In particular, she wanted to know if federal revenue has gone down over the past several decades with the enactment of lower tax rates and various tax exemptions.

The answer is yes.

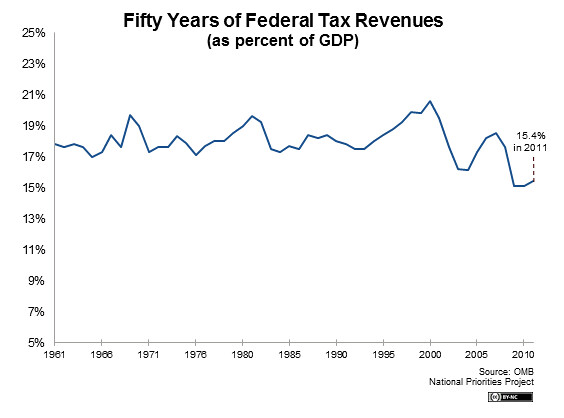

Federal tax revenues as a share of GDP are at their lowest point in half a century. GDP, which stands for Gross Domestic Product, measures the size of the economy. In fiscal 2011, revenues were around $2.3 trillion, or 15.4 percent of GDP — down from a post-World War II high of 20.6 percent in 2000.

Ronda wanted to know the total amount of money lost as a result of all tax breaks. While we aren’t able to calculate the total number, we can put numbers to a few specific policies. One of the most expensive kinds of tax exemptions, according to the Office of Management and Budget at the White House, is the exemption for employer-sponsored health care. That’s expected to cost the federal government around $1 trillion in fiscal years 2013 through 2017. Other costly tax expenditures include the deduction for home-mortgage interest, which will cost $606 billion between 2013 and 2017; and the preferential tax rate for capital gains, which will cost around $321 billion. These are only a couple of tax exemptions, but they’re big numbers as compared to overall tax revenues. In other words, Ronda, all tax breaks combined would be, well, huge.

The Bush-era tax cuts which were extended by President Obama have been very costly. Since they were initially enacted in 2001, those lower tax rates have cost the U.S. Treasury around $3 trillion. More than $1 trillion of that has benefited the wealthiest 5 percent of Americans. (See more at CostOfTaxCuts.com.)

At National Priorities Project, we liked Ronda’s question so much that we’re going to do some more investigation. Stay tuned...