You Ask, We Answer: How Big Are the Bush Tax Cuts?

By

Mattea Kramer

Posted:

|

Budget Process

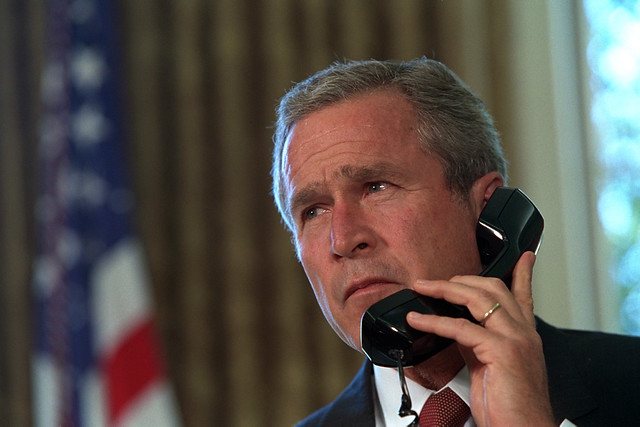

The U.S. National Archives/ flickr

A reader from Shelby Township, Michigan, wrote to us to ask about the Bush-era tax cuts. "How much revenue would the federal government get," he wrote, "if taxes were raised on the people making more than $200,000 per year?" It's a very timely question. Bush-era tax cuts for high earners are the most contentious part of negotiations raging over the so-called fiscal cliff.

In Washington, Republican lawmakers have put their support behind extending the entire package of Bush-era tax cuts while Democrats say they want to see the tax cuts expire for individuals making over $200,000 and families making more than $250,000. Estimates suggest that allowing those tax cuts to expire would bring in roughly $83 billion in additional tax revenue in 2013, according to the Treasury and calculations by the forecasting firm Moody's Analytics.

There's been a lot of argument over whether allowing those high-end tax cuts to expire would be devastating for the economy. According to Moody's, allowing the Bush tax cuts to expire for those high earners would lead to a contraction of around 0.003 percent of the U.S. economy – in other words, no economic calamity.

For more on the so-called fiscal cliff, check out Fiscal Cilff Definition and What Will Happen with the Fiscal Cliff?