Unemployment Insurance: An Overview

By

Samantha Dana

Posted:

|

Social Insurance, Earned Benefits, & Safety Net,

Transparency & Data

I. Summary

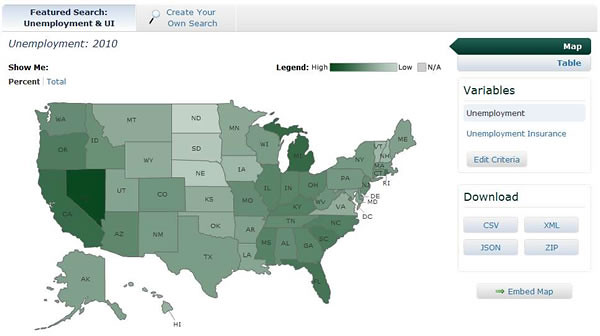

In conjunction with Labor Day and our current featured data story on unemployment, we present a primer on the complex world of unemployment insurance. Unemployment Insurance (UI) is a joint venture between the federal government and the states: each state sets its own recipient critera based on federal guidelines.

The federal government collects taxes from employers, which go into a Trust Fund that pays for administrative costs, state loans, and extended benefits. States collect employer taxes too; these fund the first 26 weeks of unemployment benefits.

During long periods of economic downturn, the federal government has two ways to help states with the highest rates of unemployment:- the extended unemployment program

- emergency unemployment compensation.

The former is funded by the Unemployment Trust Fund. The latter is funded by the US Treasury; therefore, extending it requires Congressional approval.

II. Federal Revenue

Both the state and the federal government collect unemployment tax from employers. The federal government’s rate was previously 6.2% of the first $7,000 each employee makes, about $56 per employee after tax credits. However, the rate is now 6% after Congress let a 1976 0.2% temporary increase lapse. This decrease will cost the federal government $1.4 billion over the next ten years.

The federal government pays for many programs with these taxes:- states’ costs for administering unemployment programs (like postage for all those checks)

- full federal worker and railroad unemployment benefits

- half of extended benefits (more on that in a moment)

- loans to states that cannot pay the first round of benefits (take a look: $8 billion to California alone this year)

III. State Revenue

States levy a separate employer tax to fund beneficiaries’ first 26 weeks of unemployment payments. Alaska, New Jersey, and Pennsylvania get additional unemployment revenue by taxing employees as well.

State unemployment tax rates vary by both employer and state. The Employment and Training Administration of the Department of Labor (DOLETA) oversees this vast, complicated system, and is a fantastic resource for more information. This overview is a good start.

IV. Extended Downturn

The United States is currently experiencing one of the greatest economic downturns in its history. As of July 2011:- 13.9 million Americans were unemployed and looking for work

- 8.9 million were underemployed (working part time involuntarily)

- 2.8 million were marginally attached (not actively looking for work but available and willing).

While that sounds like a lot of people for the unemployment insurance program to support, DOLETA estimates that only 3.6% of the country is both unemployed and receiving benefits, as opposed to the 9.1% out of work total (which doesn’t include the underemployed and the marginally attached).

When unemployment remains high in periods of economic downturn, the federal government helps states fund their overflowing unemployment obligations.

Extended Unemployment Act

Under the Federal-State Extended Unemployment Act of 1970, extended benefits kick in when a state’s insured unemployment rate:- goes above 5%

- or is 120% of the previous 2 year average.

The cost of this program is usually split by the federal government and the qualifying states. Currently, under the provisions of the American Recovery and Reinvestment Act (stimulus package), the government pays 100% of extended benefits through January 4, 2012.

Emergency Unemployment Compensation

The other way the federal government supports struggling states and unemployed persons is the Emergency Unemployment Compensation (EUC08) system, which comprises the unemployment tiers so often mentioned in the news.

The laws governing these tiers have been amended eight times as the employment situation becomes worse and people go longer stretches without employment. (In fact, the number of long-term unemployed is at record highs.)

The number of states paying each tier, and the amount of benefits paid to beneficiaries, declines with each tier. For example, Tier I provides up to 20 weeks of benefits and is available in all states, while Tier IV pays 6 weeks in states with 3 months of 8.5% unemployment or higher.

Each tier is wholly funded by the federal government, and since the passage of the stimulus package, the money for this program comes out of the general fund of the U.S. Treasury and not the Unemployment Trust Fund. That’s why Congress has to keep extending benefits; it’s not coming out of the trust fund paid for with unemployment taxes.

V. Outlook

The National Employment Law Project notes that unless Congress re-authorizes the EUC system, the newly unemployed as of July 2011 will not receive any of the tier benefits. Those currently in the system will be grandfathered and allowed to collect the remaining benefits of their current tier.

The White House is currently considering a “jobs bill”, which may include a provision to help the long-term unemployed. The federal government would continue to pay unemployed workers benefits while allowing businesses to hire the beneficiaries for a trial period without paying wages. Although the President has not finalized his plan, renewing the Emergency Unemployment Compensation package is not currently on the table.