Why the Top Marginal Tax Rate Will Never Bother You

By

Kyle Andrejczyk

Posted:

If you're anything like me, it's because you simply don't make enough money to be taxed at the top marginal rate. A “marginal rate” is the rate at which your last dollar of earned-income is taxed. These “marginal dollars” are the dollars at the very upper edge of your income. The “top marginal rate” is simply the highest marginal rate in the U.S. tax code...something that most of us will never see.

If you're anything like me, it's because you simply don't make enough money to be taxed at the top marginal rate. A “marginal rate” is the rate at which your last dollar of earned-income is taxed. These “marginal dollars” are the dollars at the very upper edge of your income. The “top marginal rate” is simply the highest marginal rate in the U.S. tax code...something that most of us will never see.

With discussion of raising taxes on the wealthy going on in the debt-ceiling talks right now, I've been noticing a lot of people focusing in on the top marginal tax rate. Specifically, I've been hearing people say why it shouldn't be raised. Whether or not raising taxes hurts or helps the economy is a highly debatable point and one I won't be discussing here. Instead, I'm going to tell you why you personally shouldn't mind if the top marginal tax rate is raised.

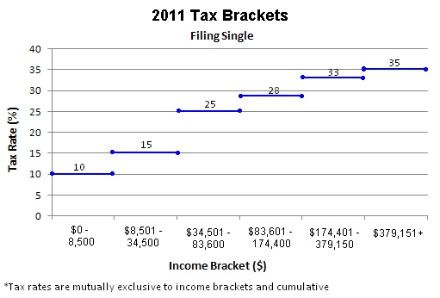

This is essentially how you get taxed. Different parts of your income are taxed at different rates and in cumulative fashion. I can almost see the look on your face now... ![]()

Let me give you an example. Let's say you're single and you earned $34,501 in 2011. For the sake of simplicity we'll ignore exemptions and deduction. The first $8,500 you earned is taxed at a rate of 10%. The next $26,000 you earned is taxed at 15%. And that very last dollar you earned — your marginal income — is taxed at 25%. This is a graduated system and an essential part of our progressive tax code, which puts a proportionately larger burden on high-wage earners. So even though you're in the 25% marginal tax bracket, you're only losing 25 cents as a result. In this example you'd be paying a total of $4,750 in taxes...plus 25 cents. This means your average tax rate is something like 13.6% — well below the 25% bracket that last dollar bumped you into causing you to groan with melancholy and infinite sadness.

The takeaway? Whatever tax bracket you're in, your entire income is not being taxed at that rate. Only a portion of it is. So to be affected by the top marginal rate, you would have to earn at least $379,151 in wages. And even then, it would only apply to wages earned over $379k.

Right now the top marginal rate is 35% as a result of the Bush-era tax cuts. Under Clinton it was 39.6% (and somehow we still managed to have a booming economy and budget surpluses). Back in 2001, only 0.7% of Americans were paying the top marginal rate. That leaves roughly 99% of us who don't have to pay the top marginal rate.*

Tax...to the Future

You see a lot of talk in the media about how the top marginal rate (which is 35% right now) is the lowest it has been since Dwight D. Eisenhower was president in the 1950s. This isn't entirely true. Under Bush 41, the top marginal rate varied from from 28% to 31%. But yes, today's top marginal is at one of its lowest points since the 1950s.

"November 5, 1955? That's the day I paid a 91% marginal tax rate.”

“That's heavy, Doc.”

That's right, McFly. In 1955 (and throughout that decade) the top marginal tax rate was a whopping 91%. This was rate was established in part to help pay down the debt the United States incurred from WWII and the Marshall Plan to reconstruct war-ravaged Europe.

That's right, McFly. In 1955 (and throughout that decade) the top marginal tax rate was a whopping 91%. This was rate was established in part to help pay down the debt the United States incurred from WWII and the Marshall Plan to reconstruct war-ravaged Europe.

<=These were the tax brackets back in 1955. This was incredibly more graduated than our current system of six brackets.

91% seems like kind of a lot to tax someone only making $200,000 a year, right? Well remember, these are 1955 dollars. In 2011, that would be $1.6 million. And even then, that 91% only applies to income earned over that $1.6 million mark.

Today, anyone making over $379,151 is only taxed 35%. That's it, you can't get a higher rate than that. If the 1955 rates were in effect today, you would be paying 35% if you earned as little as $67,000. And someone earning today's equivalent of $379k back in 1955 would be subject to a stiff 72% tax rate.

So relatively speaking, we've got it pretty good here in the future. And to think that in just four short years the Cubs will win the World Series and we'll have hoverboards!

As I mentioned earlier, the top marginal rate probably won't affect you because (aside from being historically low) statistically speaking you don't make enough money. At least 4 out 5 of us don't according to the U.S. Census Bureau. In 2008, almost 80% of household in the United States earned less than $100,000. This figure doesn't even include the households earning between $100k and $379k. So we know that at least 80% and maybe as many as 99% of Americans never have to worry about paying the top marginal rate.

Just something to keep in mind as the debt-ceiling talks continue and the Bush-era tax cuts are set to expire next year.

TL;DR – The top marginal tax rate right now is 35% and only applies to money you earn over $379k, not your whole income. Back in the 1950s it was 91%. More than 80% of Americans earn too little to have to pay the top marginal rate of 35%.

*That particular figures was pulled from 2001 data but is still a useful approximation for 2011.

* * * * * * * * * * * *

Want to “Ask Kyle” a question on this or anything else? Send it to questions@nationalpriorities.org or post your “Ask Kyle” questions on Facebook at facebook.com/nationalpriorities.