Coloradans Pay Hefty Taxes, Reap Considerable Benefits

By

Mattea Kramer

Posted:

|

Budget Process,

Health Care,

Social Insurance, Earned Benefits, & Safety Net

Colorado residents will caucus today to decide their pick for the Republican nominee for president. Choosing a presidential candidate in part means caucus-goers will consider how they want the government to spend their federal tax dollars. National Priorities Project took a look at how much Colorado residents currently pay in federal taxes, and what they get in return.

On average Colorado residents each paid $7,003 in federal taxes in 2010. Federal taxes include income and payroll taxes as well as estate taxes and the federal excise tax on gasoline, cigarettes, and other goods. Coloradans pay more in taxes than residents of most other states, in large part because Colorado on the whole is wealthy, boasting the sixth-highest median income in the U.S. in 2010.

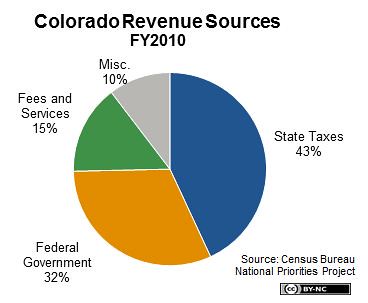

Still, considerable federal money flows into the state to assist residents and to support state and local government. According to the Census Bureau, federal money accounted for 32 percent of the state government’s revenue in fiscal 2010, or about $6.3 billion. Federal support helped Colorado provide health care for low-income residents and financed infrastructure repairs and other projects.

In addition, Colorado residents receive thousands of dollars in direct federal assistance. (See federal assistance to individuals on the state and county level here.) In 2010, the average Coloradan received $4,081 in direct federal support. Nearly half of that assistance ($1,756) was in the form of Social Security benefits, while the Medicare program comprised nearly a quarter ($922) of all federal assistance to residents of Colorado.