Primary Stakes: Federal Money Flows into Hard-Hit Michigan

By

Mattea Kramer

Posted:

|

Budget Process,

Social Insurance, Earned Benefits, & Safety Net

Primary voters in Michigan head to the polls on Feb. 28 to weigh in on the Republican nominating contest. Michigan has been hard hit by the Great Recession, and that will affect voters’ outlook in choosing their Republican nominee and a president in November. One thing the presidential election is about is voters’ vision for how the federal government should serve the American people, so National Priorities Project took a look at how Michigan currently benefits from federal spending.

The average Michigan resident received $5,846 from the federal government in 2010—benefits that largely came through the Social Security, Medicare, and unemployment insurance programs. Unemployment in the state is well above the national average, and last year more than one in every five workers was underemployed. Michigan residents paid $5,109 in federal taxes on average in 2010, a number that includes income and payroll taxes, estate taxes, as well as federal excise taxes on goods like cigarettes and gasoline. Thus residents received all of their federal taxes back in direct support from federal programs, plus additional assistance on top of that. (See these numbers for your own state.)

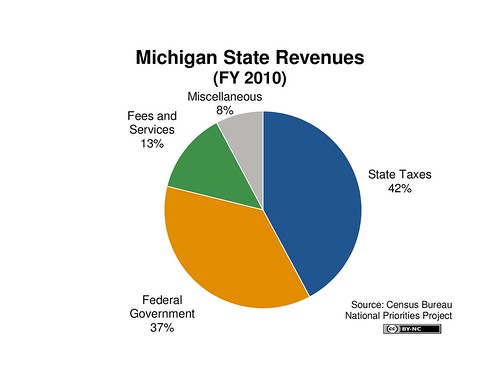

In addition to Michigan residents receiving considerable aid from federal programs, the state government relied on federal money for more than a third of its revenues in fiscal 2010.

For every dollar of revenue in state coffers that year, 37 cents came from Washington. Federal money helps the state pay for building roads and fixing bridges, among other projects, and pays for part of the cost of health care for Michigan residents who qualify for Medicaid, the health insurance program for low-income Americans.